Questions

WHAT IS THE DIFFERENCE BETWEEN LEASING AND SELLING OIL AND GAS RIGHTS (“MINERALS”)?

Lease: When you lease your mineral rights, you are normally paid an initial lump sum bonus payment or “delay rentals” over a 3-5 year period, and possibly royalty production payments over time (which would pay you a regular income stream similar to an annuity). The amount is determined by the quality of the wells drilled, your lease and many other variables. You can only sign a lease if you do not already have a lease or well on the property. Oil and gas drillers who specialize in actually drilling the oil and gas wells normally sign leases with mineral owners.

Sell: When you sell your mineral interest outright, you receive one lump sum of money when your sale closes. Typically a sale brings a larger lump sum of cash than a lease. Anyone who owns minerals can sell them, regardless of lease status. Private investment companies or individuals normally buy mineral interests.

I ALREADY HAVE A LEASE WITH AN OIL & GAS COMPANY. CAN I STILL SELL MY MINERAL RIGHTS?

Yes! You most likely still own the right to receive royalty payments in the future even if you have already leased with an oil and gas company. You may be receiving a royalty check from an old lease and old “conventional” oil and gas well that is only a few dollars per month. We purchase many oil and gas rights from landowners who have already leased. While a lease is normally a good indication that a driller is interested in drilling your property, it is not a guarantee.

You may not have your lease renewed, or the driller may experience problems creating a unit and choose to drill elsewhere, therefore delaying or potentially ending your opportunity of receiving any future royalty payments. But if you own minerals, you can sell minerals, regardless of the lease status.

I DO NOT HAVE A LEASE, ARE YOU STILL INTERESTED IN PURCHASING MY MINERAL RIGHTS?

Yes, Appalachian Clean Energy is always looking for mineral rights in parts of PA, Ohio & WV, even if they are not leased. We understand that from time to time mineral owners that have been lucky enough to receive lease bonuses may see lease bonus rates decline substantially due to declining competition for production in their area. It doesn’t hurt to give us a call, you have nothing to lose. We evaluate each purchase on a case-by-case basis.

I CURRENTLY RECEIVE ROYALTY PAYMENTS. WHAT HAPPENS TO MY ROYALTY MONEY AFTER I SELL MY MINERAL RIGHTS?

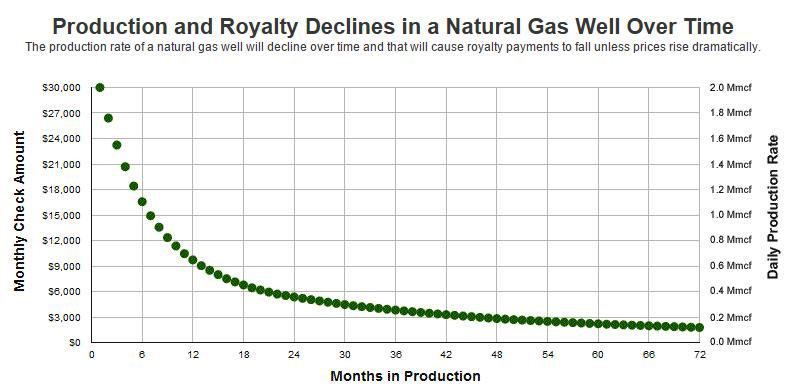

Once you sell your mineral rights, you will no longer receive royalty payments. You are trading your smaller royalty checks for a large lump sum of money. When you sell your mineral rights and the right to receive royalties, you reduce the unpredictable nature of oil and gas market prices. Royalty payments fluctuate and usually become smaller over time as the pressure and reservoir of oil and gas depletes.

YOU MENTIONED THAT MINERAL RIGHTS ARE A DEPLETING ASSET? WHAT DOES THAT MEAN?

This graph shows how the monthly royalty rate and daily natural gas production rate of a hypothetical gas well can decline during the first six years of production. For more information about declining royalty payments, please click on the following link: http://geology.com/royalty/production-decline.shtml

No matter how good a producing well is, it will eventually dwindle and stop producing when it is depleted. This is because the reservoirs of oil and gas that you own (such as the Marcellus Shale) only contain a fixed amount of oil and gas “reserves”. Once all of the oil and gas trapped in the reservoir is released through the wellbore and sold, or the well pressure decreases so much that the oil and gas cannot be recovered economically, your reservoir is depleted, meaning the remaining mineral rights will be virtually worthless. The life span of a well or field is hard to predict – it could be as short as a few years or as long as decades – making it a variable asset, unlike other investments that may hold their value longer. Even though new drilling technology has brought back to life some areas, once the oil and gas is gone, it’s gone. And once an area has been deemed “uneconomic” due to low oil and natural gas prices, the quality of the reservoir and the cost to drill the wells, then drilling stalls or even stops altogether.

HOW DO I KNOW IF I OWN THE MINERAL RIGHTS UNDER MY PROPERTY?

This question is often answered by our team of experts. If you purchased property and the mineral rights were not included in the purchase, then unfortunately you do not own the rights, and you have nothing to sell. It is possible you purchased property from a seller who themselves never owned the mineral rights. Fortunately, if you agree to sell with Mineral Funding Solutions, we do have a team of experts that will search your mineral title and make a determination as to whether or not you own your mineral rights.

Good indicators (usually right, but never 100%) that you DO own your oil and gas rights are:

1. You have leased the oil and gas in the last 5 to 10 years and received a bonus payment in excess of $500/acre.

2. You are receiving monthly royalty checks, even if the amount is small and the payment is for a conventional well.

Good indicators (usually right, but never 100%) that you DO NOT own your oil and gas rights are:

1. You signed a lease in the last 5 to 10 years and your bonus was not paid due to title failure.

2. There is an oil or gas well on your property but you do not receive monthly royalty checks.

3. Your property used to be owned by a coal or timber company.

IS THE QUOTE AND RESEARCH FREE?

Yes! We bear all the costs of evaluating for our quote, searching title, closing and preparing any documents. You may need to pay taxes (most likely capital gains on the sale which is usually a lower rate than regular income from lease bonuses and royalty payments), so you should consult a Certified Public Accountant for tax advice.

YOU SAID THAT YOU CAN CLOSE IN 30 to 90 BUSINESS DAYS, IS THAT REALLY TRUE? IS IT COMPLICATED?

We pride ourselves on doing what we promise, and being fast and dependable. And actually from start to finish, we make it simple and easy to understand. We provide fast, straightforward evaluations and closings. Always feel free to ask as many questions as you like. We never pressure you into making a decision that you do not feel comfortable with even if that means a deal doesn’t close. It’s 100% your decision on whether or not you’d like to sell your minerals to us. After you sign a purchase and sale agreement, we run title and other due diligence. This is followed by a closing, at which time you sign a mineral deed and you are paid. This process normally takes 30 to 90 days.

I’M NOT SURE IF I WANT TO SELL ALL OF MY MINERAL RIGHTS, CAN I JUST SELL SOME OF THEM?

Yes, you can. You don’t have to sell all of your oil and gas mineral rights. We will consider buying a portion of them – half, a third, a quarter – depending on what you would like to sell and the amount of money you want to raise. Partially selling can be getting the best of both worlds to some degree. You will get cash now and if a well is drilled, you will be able to collect a portion of the royalties in the future also.

WHAT HAPPENS TO MY MINERAL RIGHTS AFTER I SELL THEM TO YOU?

One of our investment companies backed primarily with local investment money will manage the minerals, and wait patiently, holding the mineral rights until production takes place, or will start collecting royalty checks if you sell producing minerals. Our investment companies own multiple different properties throughout PA, WV, and Ohio, so they are playing the percentages that enough of their properties will be put into production at estimated rates and commodity prices in a timely fashion in order to generate a profit over a long period of time. At times, for business or tax reasons, the investment company may sell or transfer mineral rights to another company and/or exchange them for a different property and/or minerals.

I WANT TO SELL MY MINERAL RIGHTS, BUT I LIVE ON THE PROPERTY, HOW WILL THIS AFFECT MY LAND?

If you have these concerns, please let us know when you call. We have been able to work with surface landowners to structure sales that maximize the control that they have over surface oil and gas activities even if they no longer own all or a portion of their mineral rights. Our investors are local landowners themselves, so we understand landowners’ concerns.

I WANT TO SELL THE LAND WITH THE MINERALS. DO YOU BUY LAND ALSO?

Yes. Our investment companies have bought land above the minerals purchased before, and evaluates land purchases on a case-by-case basis.